Note: The following e-newsletter was sent to Sen. Shelly Short’s subscribers March 29, 2025. To subscribe to Sen. Short’s e-newsletters, click here.

Dear Friends and Neighbors,

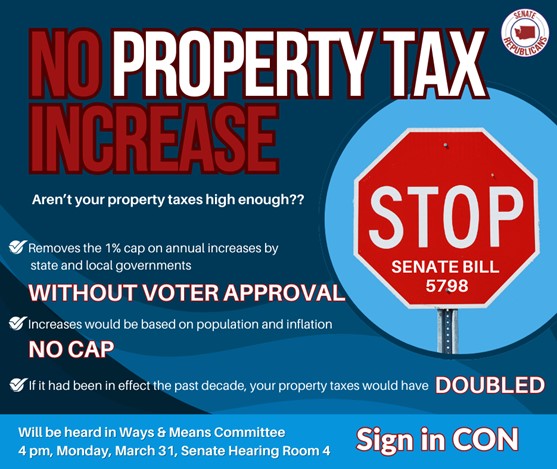

One of the worst tax bills of the year gets a hearing Monday in the state Senate – a bill that would unleash enormous property taxes across the state. If you want a say in it, this is your chance.

One of the worst tax bills of the year gets a hearing Monday in the state Senate – a bill that would unleash enormous property taxes across the state. If you want a say in it, this is your chance.

Senate Bill 5798 would remove the state’s limit for property taxes that can be enacted without voter approval. Since 2007, property taxes have been kept in check by a state law limiting annual increases to 1 percent. This bill would change that restriction to a factor of population growth and inflation, effectively eliminating any restraint on property tax increases. If this bill had been in place 10 years ago, your property taxes could be double what they are right now.

This is one of the most harmful tax proposals I’ve ever seen. At a time when Olympia is just starting to recognize we have an affordable housing crisis on our hands, this would increase the cost of homeownership and drive up rents. By taking the brakes off property taxes, we raise the prospect that people will be taxed out of their homes. This is one of several big-ticket tax proposals we will be debating in the four weeks that remain of our 2025 legislation, and it is the one that poses the most immediate threat to the people of Washington.

What can you do?

Olympia needs to hear what you think. You can register your opinion with the Senate Ways and Means Committee before the meeting starts at 4 p.m. Monday, March 31.

Olympia needs to hear what you think. You can register your opinion with the Senate Ways and Means Committee before the meeting starts at 4 p.m. Monday, March 31.

You can sign in CON by clicking here. At this link, you also can testify against the bill and/or submit written testimony.

This is a time when numbers count. As of Saturday morning, a record 14,000 people had signed in against the bill, more than we have ever seen before. The more voices, the better our chance of defeating it. This is what it is going to take.

Worse than last year’s proposal

If this legislation sounds familiar, it’s because local governments have been pushing this idea for the last five years. What they aren’t saying is that they have authority to enact big tax increases already – they just have to ask permission from voters. What they’re really trying to do is to prevent you from having a voice in the matter.

Last year public pressure helped defeat a proposal that would have allowed local property taxes to grow at triple the current rate. The House is considering a similar proposal again this year. The one before us in the Senate is even worse. It ends the cap on both state and local property taxes and allows taxes to grow even faster. How much faster? Over the last 10 years, on average, it would have enabled property taxes to grow at 4.7 times the current rate. Some years, if state and local governments took full advantage, it would have allowed increases eight times greater than at present.

The compounding effect of these tax increases would quickly add up. Let’s suppose the statewide impact is $200 million the first year, and the increases continue at the same rate, year after year. By year six, the cumulative impact would be $1.7 billion – and it would just keep climbing.

Allows government spending to keep skyrocketing

Local governments do an important job, and all of us will acknowledge that. But in the Puget Sound area especially, they have chafed at the 1-percent limit as homelessness and the spread of fentanyl have placed new demands on social services. Nothing has prevented local governments from going to voters and making the case for more money. But they know the people’s patience is wearing thin, as their taxes increase, government policies prove ineffective, and no amount of money appears to make a difference. Ask voters too many times and they’ll start saying no.

The implications of this measure are even worse. Easy money for local governments eliminates incentives for efficiency and cost-effective spending. Olympia will shift responsibilities to the local level, allowing skyrocketing growth to continue. State government expenditures have doubled over the last decade. This unsustainable spending has finally hit the wall this year, outstripping the amount we have coming in and resulting in a $7 billion deficit. By effectively ending restraints on local taxes, current legislative leaders can keep stoking the growth of government and avoid the need for fiscal discipline.

One element in a most taxing debate

This property tax legislation is one element in the most significant debate we have had about taxation over the last 15 years. The rapid growth of state government spending, coupled with unwise decisions by our majority Democratic colleagues, have put the state deep in the hole. This is just one of many tax proposals the Legislature is considering this year that would dig our hole even deeper.

The most troubling element is that none of this is necessary. The budget can be balanced without a tax increase and without harmful cuts. We proved it in the $ave Washington proposal released two weeks ago by Senate Republicans. You can read about it here. The more we see of this year’s tax-and-spending proposals, the better ours looks by comparison. To put state government on a sustainable path, all we need to do is avoid new spending for non-emergency purposes and enact sensible efficiencies. Let me say it again: It really is that simple.

Listening to you!

Thank you to everyone who participated in our 7th District telephone town hall meeting! On Thursday I joined with my seatmates, Reps. Andrew Engell (left) and Hunter Abell (center), for an hour-long community conversation about the 2025 legislative session. Our district is the largest in the state, covering some 20 percent of Washington’s land mass, and we have found these telephone town halls offer an excellent way for people across Northeastern and North-Central Washington to let us know what they are thinking.

This turned out to be one of the biggest meetings our delegation has held in years. We heard loud and clear your frustrations with state government – the growing intrusiveness of state policy, infringements on constitutional rights, policies that increase gas prices and the cost of living, and much, much more. We’re with you on these issues. And we hope to hear more from you in the future. If you have a comment about a state agency or a concern about the direction of state government, please reach out to our offices. Our most important duty is to serve you.

Thanks for reading!

Sen. Shelly Short, 7th Legislative District

Contact me!

Email: Shelly.Short@leg.wa.gov

Mailing address: P.O. Box 40407/ Olympia, WA/ 98504

Website address: https://shellyshort.src.wastateleg.org/

Legislative Hotline: 1 (800) 562-6000