Note: This e-newsletter was distributed to Sen. Shelly Short’s subscribers on April 10, 2025. To subscribe to Sen. Shelly Short’s e-newsletters, click here.

See speech by clicking here or on video above.

When the budget came up for a vote on the Senate floor March 29, I pointed out that it lacked balance. It might address the needs of government and fulfill the wish-lists of our majority colleagues, but what about the people who have to pay for it? Senate Republicans have released a budget of our own, using the same numbers, demonstrating that we can balance the budget without new taxes or harmful cuts, simply by avoiding big new spending. This year’s proposals for steep new taxes are entirely unnecessary.

Dear Friends and Neighbors,

The fight is on against the biggest tax increase in Washington history. Our Democratic colleagues want to raise taxes by an astonishing $20 billion or so, to prop up unsustainable spending decisions that have put the state in the red. To enable skyrocketing spending to continue, they are proposing massive increases in property taxes, new taxes on jobs and investments, and higher fees for everything from state park access to hunting and fishing licenses.

Over the last several weeks, opposition has been mounting – from the public, the business community, and even Gov. Bob Ferguson, who last week took the unusual step of chiding his own party for its fiscal irresponsibility and threatened a veto. With three weeks left to go in our 2025 session, there is no telling what will happen.

House and Senate majorities have passed their budget bills, and they have sent them to a conference committee for final negotiations. What this really means is that budget leads for the House and Senate Democrats will work out their final proposal behind closed doors. Will our colleagues remain obstinate? We’ll find out in a week — that’s when they promise to present their revised proposal to the Legislature.

Here’s where things stand as we begin the final act of the 2025 session.

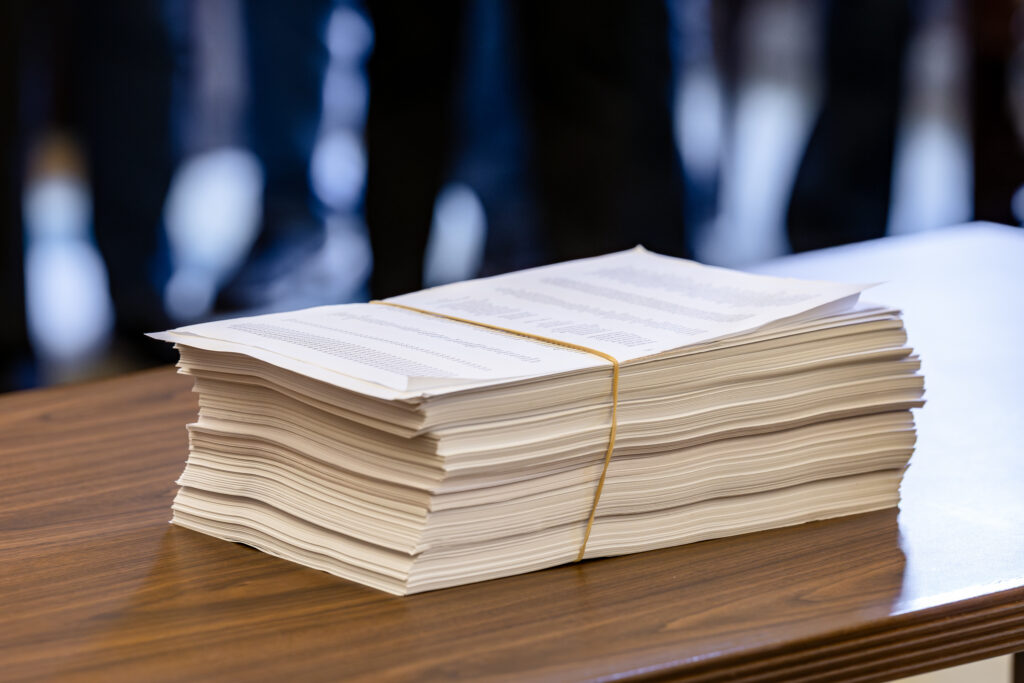

Record opposition to property tax plan

This is what 43,680 sign-ins look like when they are printed out on paper. That’s a pretty big stack, isn’t it? This is how many people registered their opposition to a Democratic proposal for property tax increases when it got a hearing in the Senate last week. This is a record. The Legislature has permitted the public to offer their opinions on legislation online for the last several years, but until this year’s proposals for massive property tax increases we have never exceeded 10,000 sign-ins on an individual bill.

It just goes to show — when our colleagues talk about raising property taxes, they hit people where they live. The Senate version of the bill would eliminate a 1 percent limit on annual property taxes without a public vote, and instead impose a limit based on inflation and population growth. That’s no limit at all, and if this had been in place over the last decade, property taxes could have increased on average five times faster than at present, and local voters would have had no say. The owner of a typical home could be paying $2,000 more today, and the figure would just keep increasing because it would compound annually. Our friends tend to argue that public opinion is irrelevant and that decisions should be left to experts such as themselves. Here we have nearly 50,000 people who are telling them otherwise.

Business sounds an alarm

Washington’s leading businesses are warning that the Democratic tax proposals threaten our state’s economy. These include a tax on high-paying jobs and a tax on investments – two things we could use more of in this state, not less. The warning came in the form of a letter last week signed by the CEOs of Washington’s 60 biggest companies, including Alaska Airlines, Amazon, Boeing, Costco, Microsoft and others. The letter says:

“These proposals would result in the largest tax increases in state history, perpetuating a dangerous trend of unsustainable spending growth. Over the past decade, the state operating budget has more than doubled, with a 37 percent increase in just the last four years. This growth far exceeds state increases in population, inflation and personal income, threatening our economic stability.”

Steep increases in hunting and fishing licenses proposed

Our Republican colleagues in the House make the point that many elements of these proposals “tax the joy” out of the state of Washington. This seems apt, with steep increases in fees for liquor licenses and Discover Passes providing access to state parks, and even new taxes on online dating services. One of these killjoy proposals misses the mark by a mile. Senate Bill 5583 would increase fees for hunters and fishers nearly 40 percent, and would allow the state Fish and Wildlife Commission to impose additional surcharges to license fees if it deems them necessary.

What our urban friends fail to understand is that hunting and fishing are a part of our way of life. For many families in North-Central and Northeastern Washington, this isn’t a matter of recreation, it’s how they put food on the table. This bill opens the door to unlimited fee increases, and fails to protect the interests of our state’s rural regions. I was among those who voted against this measure; unfortunately it passed the Senate 25-24 and now awaits further consideration in the House.

Governor draws the line

Our colleagues may not be concerned with public opinion, but there is one voice they have to heed. Ferguson, serving his first year as governor, told his fellow Democrats to tear up their budget proposals and start over. Last week he threatened a veto if the final budget:

- Raids the Rainy-Day Fund,

- Is built on unrealistic budget projections,

- Enacts substantial new spending,

- Fails to enact substantial savings and efficiencies,

- Relies on taxes likely to be struck down by the courts, like the proposed “wealth tax” on stocks, bonds and other investments,

- And fails to fund a $100 million plan to put more law enforcement officers on the streets.

The last point is a budget proposal that speaks for itself. The other points Ferguson makes about fiscal responsibility should be obvious to everyone. The fact that he has to explain these things to his own party demonstrates how far the House and Senate majorities have strayed from common sense. We can expect major head-butting before this session is done.

At a news conference Wednesday, I joined Republican senators, homeowners, renters, landlords and real estate professionals in opposing proposals from legislative Democrats for a massive increase in property taxes. House and Senate proposals would allow property taxes to increase three to five times faster than at present. In the photo above, Senate Republican budget lead Chris Gildon explains that Washington can’t solve an affordable housing crisis by making housing more expensive. You can see this news conference here.

Thanks for reading!

Sen. Shelly Short, 7th Legislative District

Contact me!

|

Telephone: (360) 786-7612

Email: Shelly.Short@leg.wa.gov Mailing address: P.O. Box 40407/ Olympia, WA/ 98504 Website address: https://shellyshort.src.wastateleg.org/ Legislative Hotline: 1 (800) 562-6000 |